1. Core Competencies: 6 Essential Attributes of Top Suppliers

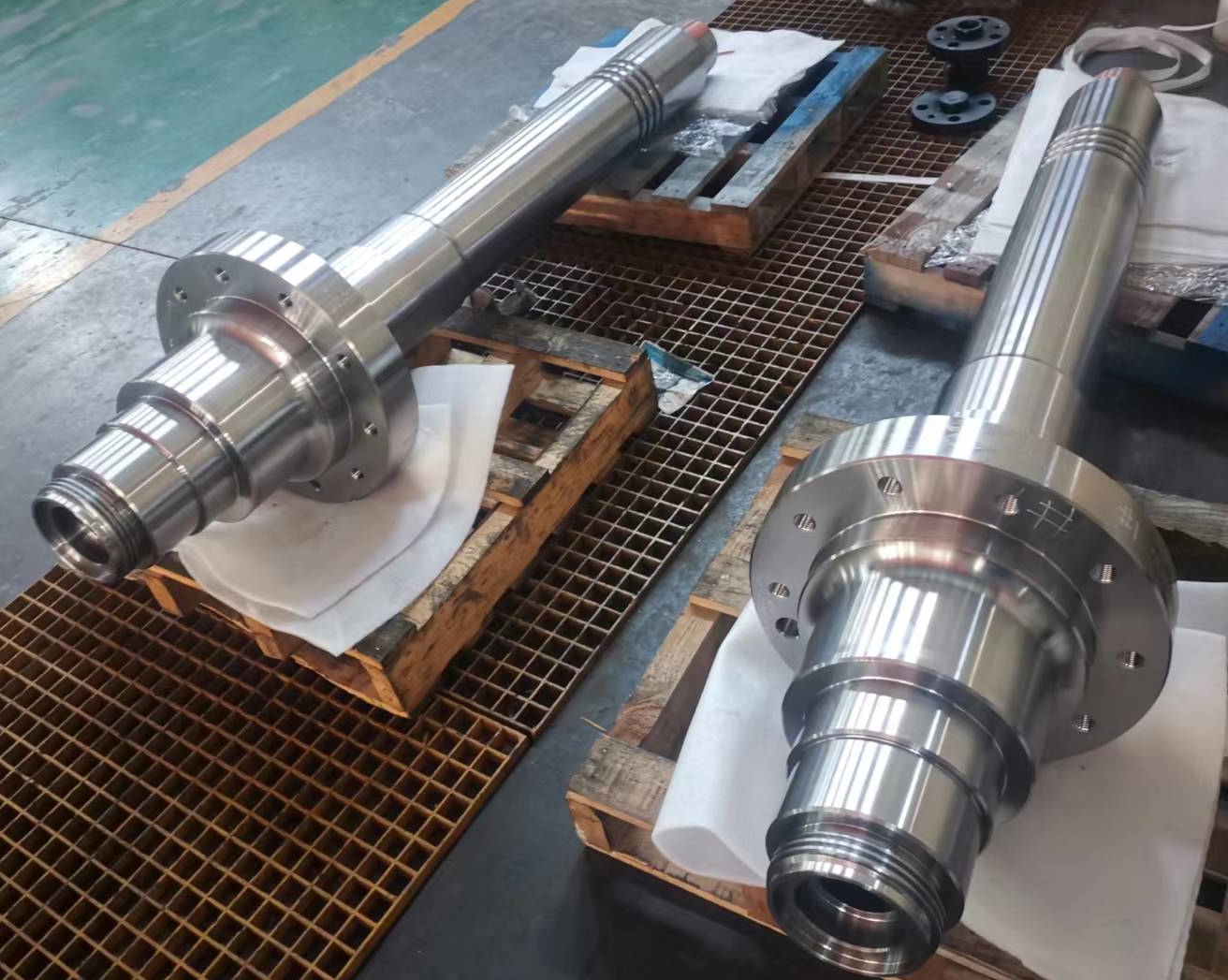

1. Machining Precision & Equipment Strength

- Precision Capabilities: Leading suppliers achieve tolerances as tight as ±0.001mm (e.g., medical implant shafts), using high-end machines like Mazak and Haas. Capable of processing parts from 0.5mm micro-components to 500mm large-diameter discs.

- Multi-Axis Technology: ≥30% 5-axis simultaneous equipment for one-step complex surface machining (e.g., aerospace blade tenons), reducing re-clamping errors.

2. Material & Process Versatility

- Material Range: Processes over 50 materials, including carbon steel, aluminum, titanium (Ti-6Al-4V), Inconel superalloys, and PEEK engineering plastics.

- Surface Treatment: Offers 20+ processes like anodizing (Ra ≤ 0.2μm), gold plating (plating thickness ±0.0005mm), and PVD coating to meet anti-corrosion, conductivity, and aesthetic needs.

3. Quality Management System

- International Certifications: Holds ISO 9001:2015, IATF 16949 (automotive), AS9100D (aerospace) certifications for process compliance.

- Inspection Equipment: Equipped with CMM (accuracy ±0.0003mm), optical comparators, and roughness testers. 100% full inspection for critical dimensions, with batch CPK ≥1.67.

4. Flexible Production Capacity

- Rapid Prototyping: Delivers samples within 72 hours (including material procurement, programming, and machining), supporting low-volume trials (5-50 pieces).

- Mass Production: Monthly capacity over 500,000 pieces, with ≥70% automated production lines to minimize human error—ideal for automotive scale scale procurement.

5. Industry Expertise & Case Studies

- Vertical Market Focus: Serves 30+ aerospace clients (e.g., Boeing/Airbus tier 1 suppliers), 50+ medical device manufacturers (orthopedic implant experience), and 100+ automotive OEMs (200,000+ new energy motor shafts delivered annually).

- Complex Projects: Successfully processed deep holes with L/D ratio 1:50 (hydraulic valve stems) and achieved 0.002mm wall thickness uniformity (aerospace fuel nozzles).

6. Global Service Capability

- Cross-Border Supply Chain: Supports DDP/FOB terms, with export packaging compliant with ISTA 3A. Average lead time to Europe/North America: 15-20 days.

- Language & Standards: Team proficient in ASME Y14.5 and ISO GD&T drawing interpretation, with seamless English/Japanese technical communication.

2. Procurement Decisions: 3 Critical Comparison Dimensions

1. Cost vs Quality: Finding the Balance

|

Indicator

|

Premium Supplier

|

Average Supplier

|

|

Unit Cost

|

10%-15% higher (precision equipment)

|

Lower (basic equipment + manual operation)

|

|

Scrap Rate

|

≤2% (intelligent inspection)

|

8%-15% (manual sampling)

|

|

Rework Cost

|

<5% of total cost

|

>20% of total cost

|

|

Total Cost Advantage

|

Saves 30%+ in hidden costs long-term

|

Short-term low price, high risk

|

2. Technical Response Speed: Core Competence in Fast Iteration

- DFM Optimization: Provides manufacturability analysis (DFM report) within 24 hours, suggesting material substitutions (e.g., aluminum for titanium to reduce costs by 30%).

- Process Innovation: Develops proprietary cutting parameters for new materials (e.g., carbon fiber-reinforced plastics), shortening customer R&D cycles by 40%.

3. Risk Control: Avoiding 3 Supply Chain Pitfalls

- Capacity Pitfall: Choose suppliers with multi-factory backups (e.g., domestic + Southeast Asia) to mitigate delivery risks from pandemics/geopolitics.

- Compliance Pitfall: Verify RoHS/REACH certifications to avoid EU market returns (one company fined $2M for lead-containing coatings).

- IP Pitfall: Sign NDA agreements and use encrypted drawing transmission to prevent technology leaks.

3. Supplier Selection: 5-Step Practical Process

1. Define Requirements

- Part Parameters: Material, size range, precision grade (IT5/IT6), surface roughness (Ra ≤ 0.4μm?)

- Delivery Needs: Annual volume, lead time, packaging standards

- Industry Certifications: IATF 16949 for automotive, AS9100D for aerospace

2. Multi-Channel Screening

- Vertical Platforms: ThomasNet, Alibaba International (filter 4+ year Gold Suppliers)

- Industry Shows: IMTS (USA), EMO (Europe) for on-site equipment evaluation

- Referrals: Supplier qualification rate from peer recommendations is 60% higher than cold outreach

3. Factory Audit Priorities

- Equipment Age: ≥80% of machines ≤5 years old (to avoid precision drift from outdated equipment)

- Document Management: Review PPAP files, SPC control charts, and first-article inspection records (kept for ≥3 years)

- Workforce Training: Technician certification rate (e.g., CNC engineer certificates ≥90%)

4. Sample Testing Process

- CMM Inspection Report: Require detailed CMM data for critical dimensions (not sampling reports)

- Assembly Testing: Automotive parts need 200-hour fatigue testing; medical parts require biocompatibility certification

5. Long-Term Collaboration Strategy

- Tiered Pricing: Negotiate 15%-20% discounts for annual purchases over 100,000 pieces

- VMI Inventory: Ask suppliers to maintain 30-day safety stock for sudden order fluctuations

4. Industry Trends: Core Competencies for the Next 3 Years

1. Intelligent Upgrades

- AI-driven tool life prediction systems reduce tool waste by 30% (e.g., Sandvik Coromant smart tools)

- MES deployment allows real-time order tracking (processing status updated every ≤15 minutes)

2. Lightweight Material Machining

- Mastering high-speed machining of magnesium alloy (AZ31B, speed ≥8000rpm) to meet EV lightweighting needs

- Developing ceramic bearing machining (roundness error ≤0.001mm) for high-speed applications in advanced equipment

3. Nearshore Manufacturing Trend

- Rising US suppliers: Local machining shortens lead time to 7 days (but costs 25% more)

- Southeast Asia footprint: Vietnam/Malaysia factories offer regional services with 10% cost savings from tariff advantages