I. Industry Status Quo

1.1 Market Size and Growth Trend

The medical injection mold market has shown a steady growth trend in recent years. According to data from Grand View Research, the global medical injection mold market was valued at $22.54 billion in 2023. It is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Data from IMARC Group shows that the market size was $23.3 billion in 2023 and is expected to reach $34.1 billion by 2032, with a CAGR of 4.2% from 2024 – 2032.

This growth is driven by multiple factors. On one hand, the medical device industry has an increasing demand for plastic parts. The production of items such as syringes, intravenous infusion components, diagnostic equipment, and surgical instruments has greatly promoted the application of injection molds. On the other hand, technological advancements have enabled injection molding to meet the high – precision and complex design requirements of medical devices. For example, it can manufacture small and precise parts that meet the functional and efficiency needs of modern medical equipment. At the same time, the widespread use of medical – grade plastics with good biocompatibility, sterilization capabilities, and chemical resistance, as well as the increase in the production of customized injection – molded parts driven by the demand for personalized medicine, have all provided impetus for market growth.

1.2 Distribution of Application Fields

Medical injection molds are widely used in multiple medical sub – fields. In medical device manufacturing, parts made by injection molds are indispensable, ranging from large – scale imaging diagnostic equipment to small wearable health monitoring devices. For example, the outer shells and internal structural parts of X – ray machines and magnetic resonance imaging (MRI) devices, as well as the outer shells and some internal components of smart bracelet – type heart rate and blood pressure monitoring devices. In the field of disposable medical supplies, products such as syringes, infusion tubes, blood collection needles, surgical gowns, and masks have seen explosive growth in demand due to the impact of the pandemic. Considering infection control, the trend of using disposable medical supplies will continue, which brings broad market space for medical injection molds. In addition, in the dental field, technologies of injection molds are also widely used in the production of appliances such as dentures and braces to achieve precise and comfortable product manufacturing.

II. Technological Development

2.1 Material Innovation

The development of materials science has brought numerous new materials to medical injection molds. Medical – grade plastics are constantly being updated. For example, polycarbonate (PC) has high strength, high transparency, and good impact resistance, and is widely used in medical device shells, optical components, etc. Polyphenylsulfone (PPSU) has excellent high – temperature stability, chemical stability, and biocompatibility, and is often used to manufacture medical device parts that require high – temperature sterilization, such as surgical instrument boxes and petri dishes. At the same time, biodegradable biomaterials are gradually emerging in the field of medical injection molding, such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), etc. These materials can gradually degrade in the body, reducing the pain of patients in removing implants after surgery, and are suitable for the manufacture of products such as absorbable sutures and tissue engineering scaffolds, opening up new application directions for medical injection molds.

2.2 Process Optimization

With the increasing requirements for the precision and quality of medical products, injection molding processes are constantly being optimized. Precision injection molding technology can achieve micron – level precision control, meeting the high – precision manufacturing requirements of medical device parts such as microfluidic chips and precision sensor components. The multi – component injection molding process can use multiple materials in a single injection process to manufacture complex parts with different functional areas, such as medical device handles with soft gripping parts and hard structural parts. The application of hot – runner technology is also becoming more and more widespread. It can reduce waste generation during injection molding, improve production efficiency, and at the same time improve product quality, ensuring more stable dimensional accuracy and surface quality of injection – molded parts, playing an important role in the production of medical injection molds.

III. Competitive Landscape

3.1 Analysis of Major Enterprises

Xiamen Goldcattle

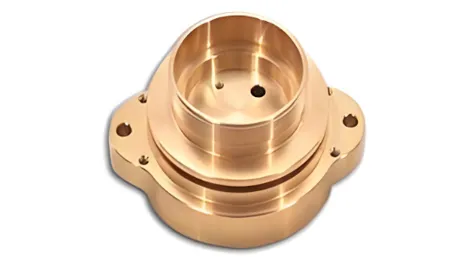

Xiamen Goldcattle is a national high – tech enterprise with certain strength in the manufacturing of medical injection molds and related parts. The company has a team of experienced and highly skilled industrial designers and engineers, focusing on mold design, manufacturing, and CNC programming. It can provide customers with one – stop solutions from mold design and manufacturing to mass production and assembly of parts. Its processing accuracy can reach ±0.001 – 0.1mm, meeting the high – precision requirements of medical products. In the medical injection mold business, it can effectively respond to customers’ urgent order needs with its advantage of rapid delivery. The company’s products cover plastic and metal parts of medical equipment, etc. It has successfully developed and produced a variety of products for customers in the medical field, and its business market covers many regions around the world, including North America, South America, Europe, Asia, and the Middle East.

3.2 Market Share Distribution

At present, the medical injection mold market is highly competitive, and the market share is relatively fragmented. Large multinational enterprises, with their advanced technologies, extensive customer bases, and global layouts, occupy a certain market share. For example, in the field of high – end medical device injection molds, some European and American companies have a high market share due to their long – accumulated technical advantages and brand reputations. Emerging enterprises represented by Xiamen Goldcattle, by continuously improving their technical levels, optimizing service quality, and leveraging cost advantages, are gradually expanding their market share in the mid – low – end market and some specific application fields. Especially in the Asian region, with the rise of the local medical industry, the market share of these enterprises has increased significantly. Overall, through differentiated competitive strategies, each enterprise competes for market share in different market segments and application fields, and the market pattern is in a dynamic state of change.

IV. Demand and Supply Analysis

4.1 Factors Affecting Demand

Population aging is one of the important factors driving the growth of demand for medical injection molds. With the increase in the proportion of the elderly population, the incidence of chronic diseases such as cardiovascular diseases and diabetes has risen. The demand for medical equipment and related disposable medical supplies continues to grow, thus driving the demand for medical injection molds. Take diabetes treatment devices such as blood glucose meters and insulin syringes as an example. Their market demand is increasing continuously with the increase in the number of diabetes patients, which in turn promotes the demand for related injection molds.

The progress of medical technology has also greatly stimulated demand. The research and development and application of new medical equipment, such as minimally invasive surgical instruments and 3D – printing – assisted medical equipment, have led to a large increase in the demand for high – precision and complex – structured injection – molded parts. For example, the slender and multi – joint structural parts of minimally invasive surgical instruments need to be manufactured through precision injection molds to ensure the flexible operation and precise performance of the instruments in a narrow space.

The occurrence of public health incidents, such as the COVID – 19 pandemic, has made people pay more attention to public health safety. Medical institutions have significantly increased their reserves and usage of disposable medical supplies, which directly leads to a sharp increase in the demand for injection molds for producing these supplies.

4.2 Analysis of Supply Capacity

Globally, there are a large number of medical injection mold manufacturers, which are widely distributed. In the Asian region, especially in China, Japan, and South Korea, due to their complete manufacturing industry chains, relatively low production costs, and a large number of professional and technical personnel, they have become important production bases for medical injection molds. Taking China as an example, not only are there enterprises like Xiamen Goldcattle with a certain scale and technical strength, but there are also numerous small and medium – sized mold manufacturing enterprises distributed in the Pearl River Delta, Yangtze River Delta, and other regions, which can meet the needs of customers at different levels.

Enterprises in Europe and the United States have technical advantages in high – end mold manufacturing, mastering advanced material research and development technologies, precision manufacturing processes, and strict quality control systems, and can produce high – precision and high – performance injection molds that meet the needs of high – end medical equipment. Overall, the global supply capacity of medical injection molds is relatively strong. However, in the high – end product field, European and American enterprises dominate, while in the large – scale production of mid – low – end products, Asian enterprises have obvious advantages.

V. Future Development Forecast

5.1 Market Size Forecast

Based on the current market growth trend and the continuous effect of various influencing factors, it is expected that the market size of medical injection molds will continue to expand in the future. If calculated according to the 5.8% CAGR predicted by Grand View Research, the market size will grow significantly by 2030 based on the $22.54 billion in 2023. With the advancement of medical infrastructure construction, the popularization of medical technology in emerging market countries, and the stable increase in the global medical industry’s demand for plastic parts, the market is expected to maintain a relatively high growth rate. Especially driven by the development of emerging fields such as personalized medicine and telemedicine, the demand for injection molds for related medical equipment and supplies will become a new driving force for market growth.

5.2 Outlook on Technological Trends

In the future, medical injection mold technology will develop in the direction of higher precision, higher efficiency, and greater environmental friendliness. In terms of precision manufacturing, with the integration of cutting – edge technologies such as nanotechnology and injection molding processes, it is expected to achieve sub – micron or even nanometer – level precision control, meeting the manufacturing requirements of ultra – precision medical device parts such as biochips and nerve stimulators. In terms of efficient production, automated and intelligent injection molding production systems will be more widely used. By introducing industrial robots and artificial intelligence algorithms for production process monitoring and optimization, production efficiency can be greatly improved, labor costs can be reduced, and the product defect rate can be decreased. In terms of environmental protection, the application of biodegradable materials in medical injection molds will become more widespread. At the same time, energy – saving and emission – reduction technologies in the production process will also be continuously improved to meet the increasingly strict global environmental requirements.